News & Tips

Renting vs. Buying a House: Which is Better?

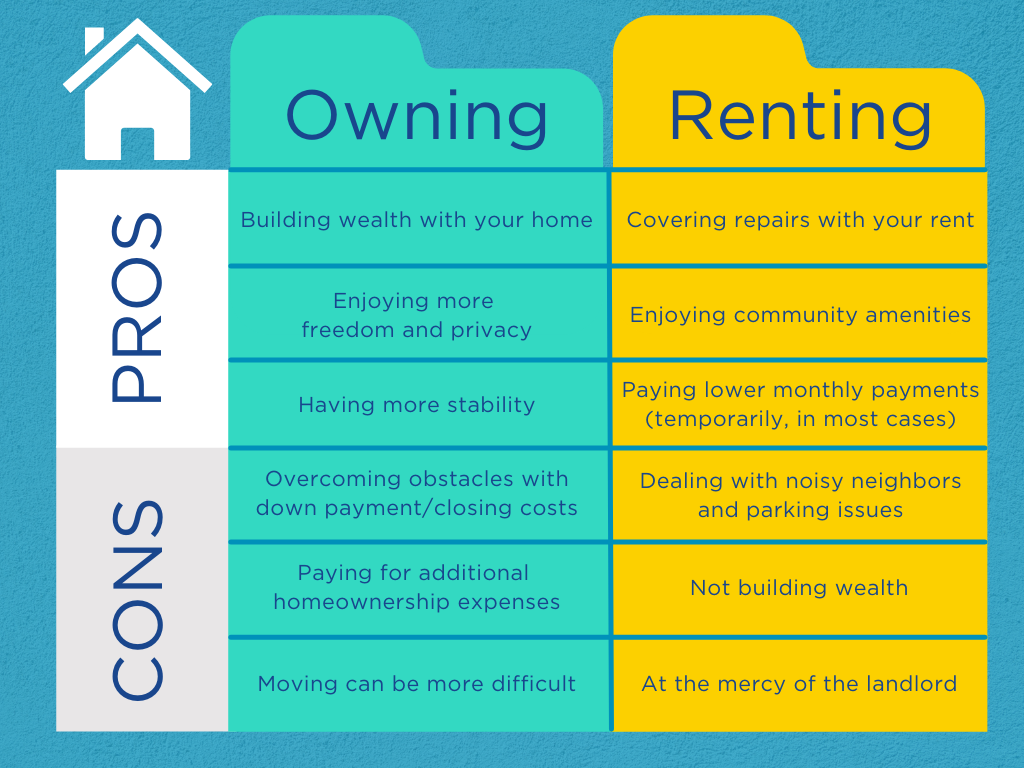

With Americans spending more than 37% on average for housing costs, choosing to rent vs. buying a house can be a difficult decision. Both the rental and housing markets have been roller coasters in the last couple of years with the changing economic landscapes. While renting offers some alluring benefits, especially temporarily, for many people, owning a home means they’ve achieved the American dream —they’ve “made it.” In this article, we look at the pros and cons of renting vs. buying to help you decide which path might work best for you.

If you're interested in comparing costs, see our mortgage vs. rent calculator.

Pros of Owning a Home

Owning a home brings both tangible and intangible benefits that are hard to ignore. Let’s take a look at some of the top ones that bring peace of mind to homeowners:

1) Building wealth with your home

While you won’t find any guarantees with housing markets, the upside with home ownership, in most cases: You’re making a smart investment. You’re building equity over the years as you pay off your mortgage and your home appreciates in value (cha-ching!).

In the first couple of years, you may be paying more for your home due to private mortgage insurance (PMI) and interest than you would be with renting. However, once you’ve paid off the mortgage, you no longer have to make such large housing costs, which is especially useful when it comes time to retire! You may also be able to look into renting out your home or selling it to downsize.

Bonus: Homeowners sometimes benefit from mortgage interest and insurance deductions, so be sure to consult with a tax advisor to ensure you’re getting those tax breaks if you’re eligible. You may also be able to tap into that hard-earned equity in the future to cover tuition costs, renovations, repairs, and more.

2) Enjoying more freedom and privacy

You can paint the rooms whatever colors you choose, add ornate landscaping, update the cabinetry—the sky is the limit with the changes you can make to your home and property. Plus, getting your own parking space, possibly a garage, and likely extra space for storing things like boats and recreational vehicles. You also won’t have to deal with upstairs or downstairs neighbors. And, you’ll have more freedom with your pet choices without paying extra housing fees. In sum, you’re the architect of your home’s future.

3) Having more stability

A home often offers a more solid foundation to build a life in one place for all ages. You also don’t have to worry so much about a landlord raising your rent every year or asking you to leave if they decide to sell the property. If you go with a conventional fixed-rate home loan, it’s a good feeling knowing exactly what your principal and interest payments will be for years to come (not including insurance and taxes).

Cons of Owning a Home

Of course, it’s a good idea to also consider the cons of owning a home and being prepared to handle the challenges that come along with them.

1) Overcoming obstacles with down payment and closing costs

Saving for a down payment and closing costs on a home loan can be difficult. At SCCU, we offer a variety of loans and assistance that can help reduce those initial home-buying costs:

If you’re still working on improving or building your credit, check out this article for helpful tips.

2) Paying for additional homeownership expenses

Whether you’re building a new home or buying an existing house, you’ll be responsible for extra expenses such as pest control, property taxes, possible neighborhood association fees, utilities, and homeowners insurance. You may also have to deal with unexpected repairs, such as a roof leak or an air conditioning issue.

Before you buy a home, be sure to have a qualified home inspector thoroughly inspect it to ensure you’re making a wise investment. Your realtor may also be able to make some negotiations with the sellers to accommodate for repairs.

Unfortunately, with many types of home loans, if you don’t put 20% down first, you’ll likely have to pay for private mortgage insurance until you reach 20% equity; however, if your home appreciates in value, you may be able to get a reappraisal to remove that private mortgage insurance.

And you’re more likely to get a low interest rate with the right lender. At SCCU, we offer VA Loans and Hero Home Loans58 for military members with no private mortgage insurance requirements.

3) Moving can be more difficult

Moving into a home means that you’re putting down roots. If you happen to receive a new job offer or would like your children to go to a different school, it may mean some considerable thought before making a move to accommodate those situations. With so many variations in the home market, it’s sometimes a bit of a struggle to find a new home and new buyers and even more cumbersome to get the timing right with everything involved with two closings.

Pros of Renting

Many tenants enjoy the hassle-free conveniences of renting a place, which works well if you’re always on the go and need to save time. Some of the pros are the following:

1) Covering repairs with your rent

Many people who choose to rent love that they have the landlord’s maintenance team at their disposal to make repairs to their place (as long as you’re not liable for them) since the rent covers those costs. It’s a good idea to have renter’s insurance with personal property, personal liability, and loss of use coverage. Also, the landlord may not cover reparation costs for your belongings if they’re damaged from something like a leak.

2) Enjoying accessibility to community amenities

Property management companies have become increasingly competitive over the years with the amenities they provide. If you choose to rent in a condo or apartment complex, you may have convenient access to a gym 24/7, a pool, a dog park, a hot tub, or a clubhouse with game rooms. And the best part? You don’t have to maintain the upkeep for those either.

3) Paying lower monthly payments (temporarily, in most cases)

Many choose to rent to because in many housing markets, the monthly payments are lower and they can save a bit more money each month. If you’d like more ways to save, be sure to check out this article. On average, you could save around $466 per month in Miami and $300 in Orlando by renting vs. owning a home. But, if you buy a home and pay off your mortgage, you’d be saving on average, more than $700 a month in those same cities.

Cons of Renting:

All of the conveniences of renting do come at a price. Here are the cons to keep in mind before settling on a final decision:

1) Dealing with noisy neighbors and parking issues

In some apartment or condo complexes, renters may have to deal with disruptions and disturbances that are out of their control, which can feel magnified if you’re working from home. Even worse, landlords have only so much power to deal with such issues. Also, renters may have to pay parking fees (and sometimes extra for guests), have trouble finding a spot, or risk the possibility of getting towed.

2) Not building wealth

Unfortunately, you’re not building wealth when you rent. It’s not a total waste because it’s still housing, a place to eat and sleep. But, you’re not building equity or potentially getting mortgage or property tax deductions. Some have said that renting is similar to paying 100% in interest every month because you’re paying a landlord a large amount each month without the prospect of owning the space yourself one day.

3) Succumbing to the mercy of the landlord

Last but not least, renting comes with a lot of requirements. Some leases are more than 30 pages long with policies for the domicile, parking, restricted pet breeds, the community, and fees for anything and everything under the sun. Plus, you may only get a portion of your deposit back even if you leave the place spotless. And in some cases, landlords will randomly inspect the domicile a couple of times a year.

Save More on Your Home Loan with SCCU

Ultimately, with renting vs. owning a home, it comes down to what works best for your financial situation, lifestyle, and location. With our home loans, SCCU offers competitive interest rates, a variety of options for your needs, and no hidden terms. We also offer affordable housing funding for hometown heroes and first-time homebuyers.

As a member-owned, not-for-profit financial institution, we’re always looking out for our members’ interests and promoting financial wellness. Be sure to visit the Home Buying Center page on our website to estimate your mortgage payment and explore home buying guides, mortgage options, rates, and more. Feel free to get in touch with us by phone, Live Chat, WhatsApp, or an in-branch appointment, and a Team Member will be happy to help.

.jpg?width=430&height=257&ext=.jpg)