News & Tips

What is the Difference Between an IRA and a 401(k)?

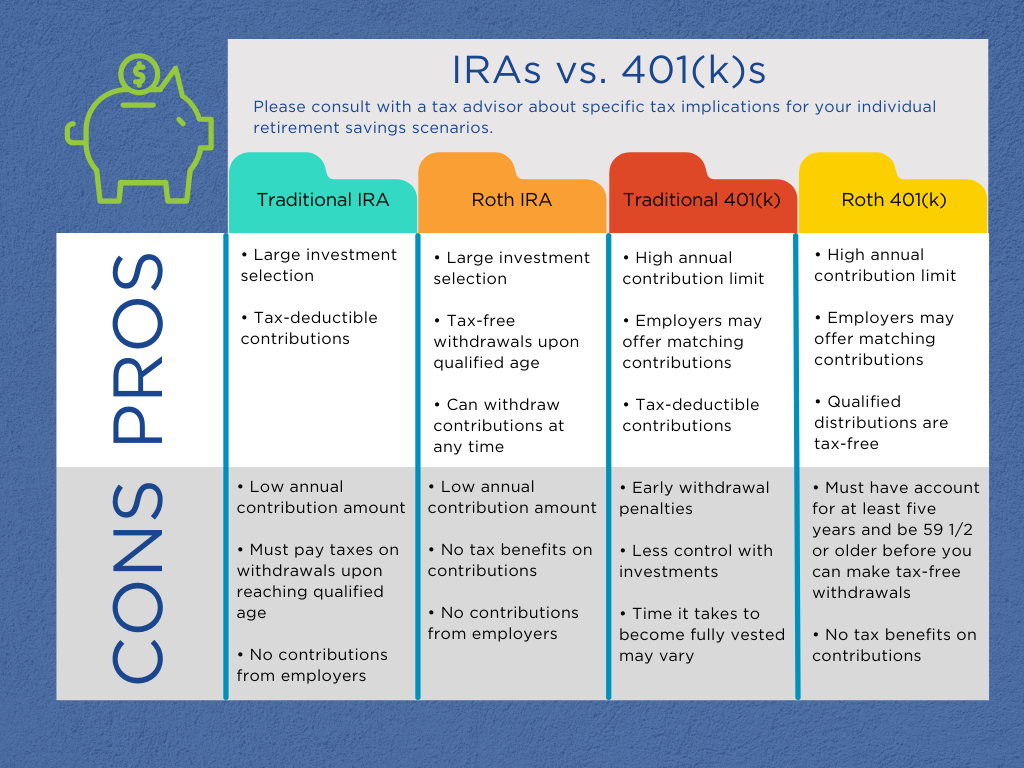

The most important thing you can do to ensure a brighter future for yourself is to start planning for retirement as early as possible. Unfortunately, a Social Security stipend will most likely not be enough to cover all of your expenses in retirement, and many companies no longer offer pensions. But maybe it sounds like people are speaking in a foreign language when they talk about the pros and cons of an IRA vs. a 401(k), which mainly comes down to taxes. This article swoops in to cover the difference between both types of retirement accounts and how they’ll help build your nest egg.

Please consult with a tax advisor about specific tax implications for your individual retirement savings scenarios.

Key Terms to Know

Before digging into IRAs and 401(k)s, it’s helpful to become familiar with some common words associated with them to ensure you understand their terms and conditions:

- Contributions—the pre- or post-tax money that you (and/or your employer) deposit into the account, typically on a regular basis.

- Earnings—money your contributions earn, such as from interest and investments.

- Distributions—the money you withdraw from your retirement account.

Note: Both IRAs and 401(k)s have annual contribution limits—the deadline to contribute the maximum amount is by the tax-filing date for IRAs and typically by the end of the calendar year for 401(k)s but can vary.

Individual Retirement Accounts (IRAs)

The two main types of IRAs are traditional IRAs and Roth IRAs. As of 2022, both of them have the same annual contribution limit of $6,000 (and an extra $1,000 for ages 50+). You can open either type of IRA by yourself and choose your own investment options.

What is a traditional IRA?

A traditional IRA is a type of retirement account where your contributions are tax-deductible and your earnings grow tax-free, but you must pay taxes on your withdrawals.

Traditional IRA Pros

- Large investment selection: You can choose your exchange-traded funds (ETFs), bonds, stocks, and mutual funds the brokerage offers (or have a financial advisor choose them for you).

- Tax-deductible contributions: With a traditional IRA, you can subtract your contributions from your taxable income each year, which lowers your income tax responsibility for that year.

Traditional IRA Cons

- Limited annual contribution amount: As of 2022, you can only contribute up to $6,000 per year ($7,000 for ages 50+).

- Withdrawal taxes and penalties: If you withdraw money before age 59 ½, you’ll incur a 10% penalty and be subject to reporting it as income and paying the taxes at that time (which could be at a higher tax rate than when you’re retired).

- No contributions from employers: As an IRA isn’t tied to an employer, you won’t receive matching contributions.

What is a Roth IRA?

A Roth IRA is a self-directed individual retirement account where you contribute with post-tax dollars, your contributions and earnings grow tax-free, and qualified withdrawals are tax-free.

Roth IRA Pros

- Withdrawals after age 59 ½ are tax-free: Since you’re contributing with post-tax money, you won’t have to worry about paying taxes on them upon meeting the age requirement.

- Large investment selection: Like with a traditional IRA, you can choose your investments.

- Can withdraw Roth IRA contributions (not earnings) at any time tax-free and penalty free: This is especially helpful if you need these funds later for emergencies (but not recommended).

Roth IRA Cons

- Limited annual contribution amount: Same as a traditional IRA, you can only contribute up to $6,000 per year ($7,000 for ages 50+) as of 2022.

- No contributions from employers: Like a traditional IRA, you won’t receive employer-matching contributions.

- Restrictions on contributions: With a Roth IRA, you pay income tax on your income before contributing to the retirement account.

- Earnings come with restrictions—they’ll be taxed with a 10% penalty if you withdraw them before age 59 ½.

Helpful tip: Whether you have a Roth IRA or a traditional IRA, it’s a good idea to aim to deposit an equal amount monthly in order to reach the annual contribution limit. For example, to reach the maximum amount of $6,000, deposit $500 a month to your IRA.

Can I have both a Roth IRA and a Traditional IRA?

Yes, as long as you meet their income qualifications, you can have both. The combined contribution amount cannot exceed the tax year’s annual contribution limits of $6,000 a year (a total of $7,000 for ages 50+) as of 2022.

| Balance | Dividend Rate | APY^ |

|---|---|---|

| $0 - $9,999.99 | 0.50% | 0.50% |

| $10,000 - $24,999.99 | 0.55% | 0.55% |

| $25,000 - $49,999.99 | 0.60% | 0.60% |

| $50,000 - $99,999.99 | 0.65% | 0.65% |

| $100,000 - $249,999.99 | 0.70% | 0.70% |

| $250,000 and over | 0.75% | 0.75% |

^APY = Annual Percentage Yield.

Consult your tax advisor for specific tax advantages related to Individual Retirement Accounts.

Rates are accurate as of the effective date displayed, and they are subject to change. The APY (Annual Percentage Yield) is a percentage rate that reflects the total amount of interest paid on the account, based on the interest rate and the frequency of compounding for a 365-day period. Fees may reduce earnings on the account.

What are 401(k)s?

A 401(k) started with section 401(k) of the Internal Revenue Code (IRC) in 1978 as a way to give workers a tax-deferred income for retirement. The two main types of 401(k)s are traditional 401(k)s and Roth 401(k)s, with the same contribution limits of $20,500 ($27,000 for those ages 50+).

What is a traditional 401(k)?

With a traditional 401(k), employees contribute pre-tax dollars, and their money grows tax-free.

Traditional 401(k) Pros

- High employee contribution amount: One of the biggest advantages of a 401(k) is that as of 2022, employees can contribute up to $20,500 (and an extra $6,500 “catch-up” for those ages 50+). The total amount (your employer + employee contributions), cannot exceed $61,000.

- Employers may offer matching contributions: In most cases, but not always, employers will match employees’ contributions. For example, let’s say that your employer will match 100% of your contributions up to 5% for each paycheck. If 5% of your paycheck is $100, the employer will contribute $100. So, essentially, free money! Typically, you can contribute more than what your employer match; but it’s good to capture at least that free money!

- Automatic untaxed deductions from paycheck: This puts saving for retirement on autopilot! You can contribute as little or as much of your paycheck as you like, as long as you don’t exceed the annual limit. Most experts recommend 10% to 20% of your paycheck, and more than 20% if you’re over 50.

- Tax-deductible contributions: With a traditional 401(k), your automatic contributions are removed from your annual wages on your W-2, lowering your income tax liability.

Traditional 401(k) Cons

- Early withdrawal penalties: You cannot withdraw money without penalties until age 59 ½.

- Less control over investments: Your employer usually chooses the funds that are available to their employees’ 401(k)s. Within those funds, you usually have the ability to choose how you’ll invest. Some employers may require that all of their contributions go into a specified fund.

- Employer requirements: You may be required to work at company for a certain amount of time before you’re eligible for a 401(k) or before you become “fully vested” in any matching funds, meaning they become yours.

What is a Roth 401(k)?

Some employers offer Roth 401(k)s, which is where you make contributions with post-tax money that’s not tax-deductible.

Roth 401(k) Pros

- Same employee contribution amount as a traditional 401(k): However, if you have both a traditional 401(k) and a Roth 401(k), then the total combined amount cannot exceed $20,500 (or $27,000 for those ages 50+) as of 2022.

- Tax-free distributions: Starting at age 59 ½, you can make tax-free withdrawals (as long as you’ve had the Roth 401(k) for at least five years).

Roth 401(k) Cons

- Not as a flexible as a traditional 401(k): You must have the account for five years and be 59 ½ or older (or due to death or disability) before you can make tax-free withdrawals of your contributions and earnings.

What if my employer doesn’t offer a 401(k) or I’m self-employed?

If you don’t have access to an employer-provided 401(k) plan, don’t worry, other options are available to save for retirement. As you’re aware, a traditional IRA or Roth IRA are ideal options. For the purposes of this article, we’ll provide you with a general overview of some alternative options, but each comes with specific requirements and limitations, so be sure to speak with a provider for more details:

- If you’re self-employed, you can also look into opening a solo 401(k): With a solo 401(k), you make contributions both as an employer and as an employee. You can choose between a traditional 401(k) or a Roth 401(k).

- For those who work at a business with fewer than 100 employees: With a SIMPLE IRA (Savings Incentive Match Plan for Employees), you can contribute up to $14,000 annually ($17,000 for ages 50+). Employers will either need to contribute 2% of the employee’s salary or match employee’s contributions to the plan up to 3% of their salary.

- For those who work at a small business or are self-employed, it’s helpful to look at a SEP (Simplified Employee Pension) IRA: This is where the employer contributes up to 25% of compensation ($61,000 cap for 2022). If you’re self-employed, you have a cap of 20% of your net income.

What do I do with my 401(k) if I leave a company?

If you have a traditional 401(k), it would be best to roll over the funds to a traditional IRA or your new job’s traditional 401(k) because then your taxes are deferred. If you have a Roth 401(k), the best thing would be to request the plan administrator to roll over the funds to your new job’s Roth 401(k) or to a Roth IRA because you won’t have to worry about incurring taxes.

Be sure to tell the plan administrator that you wish to do a direct rollover, so that your funds go directly to your new account (not to you personally) without taxes or penalties. If you choose to do a rollover from a traditional 401(k) to a Roth IRA or a Roth 401(k), you’ll owe taxes on the rolled-over amount. You cannot roll over a Roth 401(k) to a traditional 401(k) or traditional IRA.

In some cases, you can leave your 401(k) with a previous employer, but you won’t be able to make contributions or ask the plan administrator any questions. Also, if the employer goes out of business or goes bankrupt, you could lose out on employer-matching contributions if the funds aren’t vested.

And lastly, if you decide to cash out, which we don’t recommend, then you will most likely have 20% withheld for taxes and incur a 10% penalty.

Can I have both a 401(k) and an IRA?

Yes, you can have both a 401(k) and an IRA, and many experts recommend doing what you can to max out your contributions each year. Keep in mind, one’s not necessarily better than the other, and they both pose a risk of losing money because of fluctuations in the market. If you have a 401(k) with employer-matching contributions, it should be the priority before an IRA.

How much money will I need to fund my retirement?

First, ensure that you have an emergency savings account with 3-6 months’ worth of expenses. Using money from a retirement account for emergencies should be a last resort, as the funds can come at a price of taxes and/or penalties and potentially missing out on years of earnings. Check out our article on 10 Creative Ways to Save for more rainy-day fund ideas.

The amount you’ll need in retirement depends on the age you retire and your monthly expenses. You won’t have to spend money related to working anymore, such as clothing and gas for commuting. Plus, you may also have your mortgage paid off, which will slice off a big cut of expenses. (Keep in mind, you’ll still need to pay annual property taxes and homeowners insurance, which are usually part of a mortgage payment.)

Many experts recommend that you have 80% of your pre-retirement income per year and that you follow the 4% rule, where you divide that amount by 4%. For example, if you were making $60,000 a year, then you’d need $48,000 a year for retirement, or a total of $1.2 million for a 25-year retirement.

However, keep in mind that you may need to plan more for unexpected costs, such as for car or medical bills, or that you may live longer than expected. Check out our retirement calculators, which include traditional IRA and Roth IRA calculators, to help you calculate amounts specific to you.

How to Apply | Individual Retirement Accounts at SCCU

As a credit union, our members’ interests always come first. We serve these counties in Florida and have 65 branches. We offer Individual Retirement Accounts, where you can make unlimited deposits to the maximum yearly contribution and earn interest. You can get started with a $100 deposit. If you have any questions, feel free to reach out to us here, and a Team Member will be happy to help.