News & Tips

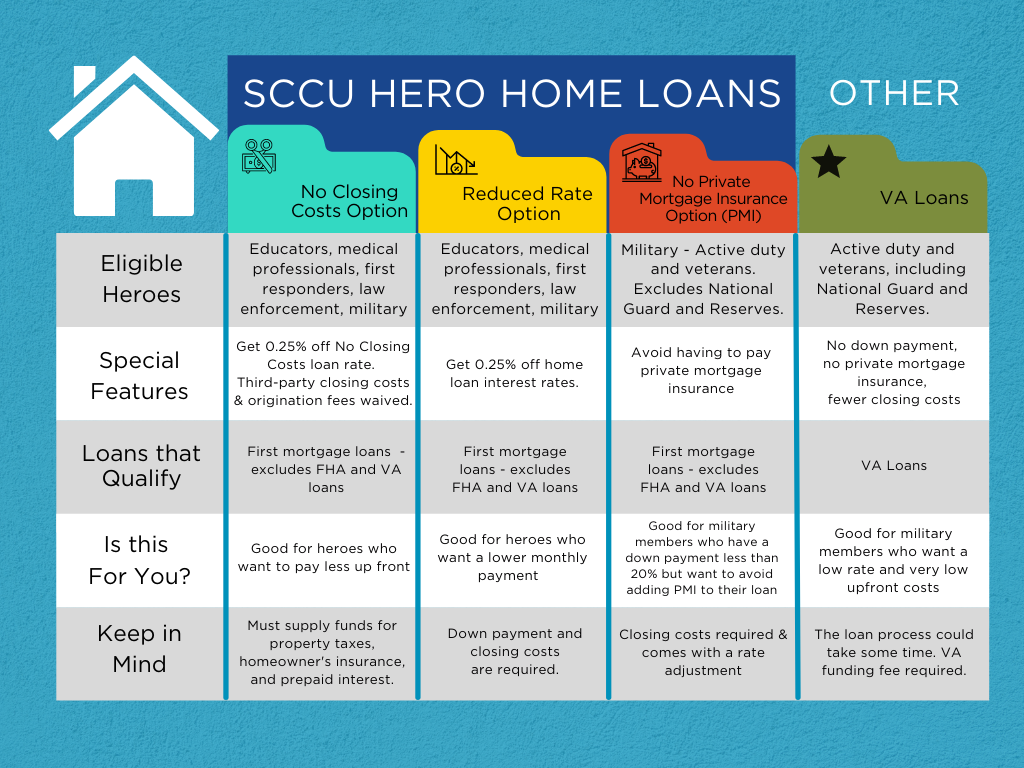

Hero Home Loans at SCCU | Comparing Your Options Guide

Veteran Mortgage Options: Your Path to Homeownership in Florida

If you’ve served our country, owning a home should be within reach — and something to celebrate. As a veteran, you have access to some fantastic mortgage benefits that honor your service. The right choice can make a big difference, not just for your monthly payment but for your long-term financial picture. We're here to help you navigate your options with confidence, so you can enjoy lasting financial health and peace of mind.

The Power of the VA Loan

One of the most valuable benefits available to veterans is the VA mortgage, backed by the U.S. Department of Veterans Affairs. This loan is built to make homeownership more accessible and affordable.

Why do so many veterans choose a VA loan?

- $0 Down Payment: Buy a home without saving for a large upfront cost—helping you move in sooner.

- No Private Mortgage Insurance (PMI): Most conventional loans require PMI with less than 20% down, but with a VA loan, you can skip that expense.

- Competitive Interest Rates: VA loans often feature some of the most competitive rates around, which keeps your payments manageable.

- Flexible Credit Requirements: The program is designed to help more veterans qualify.

- A Renewable Benefit: You can use your VA loan benefit multiple times once your previous VA mortgage is fully paid off.

Many veterans see the VA loan as an outstanding choice for their “forever home,” where these long-term benefits really shine. But if you’re buying a starter home or want to save your VA loan benefit for later, there’s another strong alternative.

SCCU’s Military HERO Mortgage: Built for Florida’s Military Community

We’re proud to offer the Military HERO Mortgage—a special program created to honor your service and help make buying a home more affordable.

Here’s what makes the Military HERO Mortgage a compelling choice:

- No Private Mortgage Insurance: Just like a VA loan, you won’t have to pay for PMI. We use a simple rate adjustment instead, which can lead to lower overall costs.

- Lower Monthly Payments: By avoiding PMI, you can enjoy more affordable payments right from the start.

- No Funding Fee: With our Military HERO Mortgage, you avoid the funding fee that’s required on VA loans—saving you money at closing.

- Faster Processing: Without VA paperwork, your loan can move more quickly, so you’ll settle into your new home even sooner.

This mortgage is a great fit if you want to keep your VA loan benefit available for the future, or if you’re buying a second primary residence and want to retain your current home with its VA loan. As long as you meet the guidelines, you can own another primary home even while your VA loan is active.

Which Path Is Right for You?

Choosing between these options may feel overwhelming, but we’re here to make it simpler. Start by thinking about your goals, and use these common scenarios for guidance:

Scenario 1: Buying your first home and planning to upgrade later

Best Option: SCCU Military HERO Mortgage

Why: This option allows you to get into a home now with great benefits like no PMI, while saving your powerful VA loan entitlement for that bigger "forever home" down the road. It gives you incredible flexibility.

Scenario 2: Buying your forever home

Best Option: VA Loan

Why: If you’ve found the home you plan to stay in for the long haul, using your VA loan is a brilliant move. The combination of no down payment, no PMI, and competitive rates provides unmatched long-term value.

Scenario 3: Purchasing a new primary residence

Best Option: SCCU Military HERO Mortgage or VA Loan (if you have enough entitlement)

Why: If you need a new primary residence but want to keep your current one as a second home, our Military HERO Mortgage is an excellent choice. It lets you finance the new home without impacting your existing VA loan. Alternatively, if you have remaining VA loan entitlement, you might be able to use it for the second purchase. We can help you figure out the numbers.

You've Served. Now Let Your Mortgage Serve You.

You’ve dedicated yourself to serving our country—now it’s our turn to serve you. Whether you’re just starting your homeownership in the Sunshine State or planning your next big move, Space Coast Credit Union is here to help you make the most of your hard-earned benefits. Our team understands the unique needs of military families, and we’re ready to guide you with a friendly smile every step of the way. Let’s find the perfect mortgage option that helps you achieve your dreams.

Ready to take the next step? Visit our Home Buying Center.

What is the Hero Program Interest Rate?

Your interest rate for a Hero Home Loan takes into account the same factors as it does for a conventional mortgage, such as your credit score, down payment amount, loan-to-value ratio (LTV), your loan term, and additionally, which option you choose.

VA Home Loans vs. Hero Home Loans

While VA Loans offer more benefits overall than Hero Home Loans, keep in mind that the VA requires a funding fee and must ensure the home you choose meets specific requirements.

Why Space Coast Credit Union for a Hero Home Loan?

As a credit union, we’re a member-owned financial cooperative that exists solely to serve our membership. In addition, we provide competitive interest rates for our Florida membership in these counties. We also promote financial education with our available resource center, Home Buying Center, and articles. Plus, we offer Hero Auto Loans too! At SCCU, we’re our Members’ Watchdog, and our brand promise is Honest People. Trusted Products. Time Valued.

How to Apply for a Hero Home Loan | Space Coast Credit Union

Have any questions? Can’t decide which option is best for you? You’ve got options for how you can contact us—by phone, Live Chat, WhatsApp, and secure messages—and our Team Members will be happy to help. If you’re ready to get started on the path to purchasing or refinancing a home with one of our Hero Home Loan options, you can apply online, in a branch, or over the phone. Our application process will detail the information and documents we need from you to get the ball rolling.

.jpg?width=430&height=257&ext=.jpg)